year end tax planning checklist 2021

There are many things I admire about my parents but one of the most poignant is how organized they were in preparing for their passing decades before it occurredYears ago my parents organized all their personal information into an End-of-Life Checklist that contained everything I needed to know. Weve obtained a deferral from the ATO so you have until 1 January 2023 to.

Tax Preparation Checklist For 2022 What To Gather Before Filing In California Oc Free Tax Prep A United For Financial Security Program

Organic growth was 6 marking a clear recovery on the prior year FY 2020.

. Being chosen as a Finalist in the 2021 CPA Practice Advisors Technology Innovation Awards. VIDEO 2020 Year-End Financial Checklist. Our advocacy partners are state CPA societies and other professional organizations as we inform and.

She also worked as a paralegal in the areas of tax law bankruptcy and family law from 1996 to 2010. We will not. Our experience representing sellers prior to the outbreak of COVID-19 was that financial buyers generally included rollover equity as part of their transaction structure.

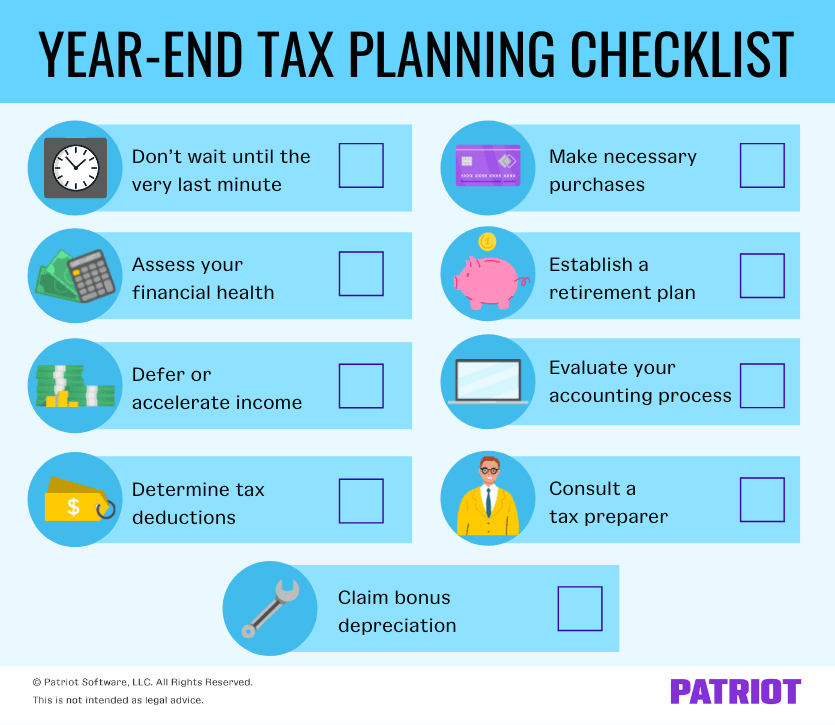

Smart Year-End Tax Planning Moves. Wolters Kluwer Tax Accounting takes a look at the congressional tax proposals that could affect tax planning for 2022 and 2023. Medical expense deductions checklist.

All you need to do is print out this page and put a check mark and the amount next to each medical expense you had during the year. Each of these expenses are tax deductible. This is a sponsored post.

Planning and Tax Advisory Services. When we see legislative developments affecting the accounting profession we speak up with a collective voice and advocate on your behalf. 10 12 22 24 32 35 and 37.

This is good to know if you want to estimate if youll have a refund or balance due at the end of the year. If your bonus totals more than 1. If you live in a state that celebrates the Patriots Day holiday such as Maine and Massachusetts you have until April 19 2022 to file your taxes.

Cooper team is here to help you start it off right. Visit MYOBs end of financial year 2021 resource page and find all the essential tax year information and dates. Get the details about disaster relief on the IRS website.

Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal Tax-Exempt Income from Fidelity Funds supplemental section of your Consolidated 1099 Tax Reporting Statement when applicable. As always all opinions are my own. Your tax bracket depends on your taxable income and your filing status.

You have to file tax returns if Your gross total income before deductions and exemptions exceeded the basic exemption limit of Rs25 lakh Rs3 lakh for senior citizens and Rs5 lakh for very senior citizens under the old tax regime. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. 2021 Year-End Investment Checklist.

Getting your businesss end of financial year work done smoothly is no small task. What is the Perfect Retirement Age. Your paycheck stub might also show year-to-date totals.

Your total sales turnover or gross receipts in business exceeded Rs60 lakh. EOFY checklist for businesses. New Retirement Account Rules COVID-19.

In 2022 it is 0585 per mile. Start planning when and how your business will transition now. There are seven tax brackets for most ordinary income for the 2021 tax year.

Audit Support Guarantee. This handy checklist offers a quick overview of the key processes and major to-do items. Consider this a checklist of small business tax write-offs.

Find the highest rated Tax Planning software pricing reviews free demos trials and more. Save the last paycheck stub to compare with your W-2. Including being named one of Accounting Todays Top New Products of 2021.

If you live in one of the areas affected by natural disasters in 2021 you may qualify for a tax filing deadline extension in 2022. Pre-Sale Process Succession Planning for Business Owners. Business and Tax Planning Fundamentals Including the Impact of COVID-19.

Beverly has written and edited hundreds of articles for finance and legal sites like GOBankingRates PocketSense LegalZoom and more. Full-Year 2021 Results. Tax planning With new incentives for digital purchases and skills training announced as part of the recent Federal.

As the tax season begins the Mr. Each January we provide our customers a year-end tax statement that summarizes key mortgage and tax information from the previous. Compare the best Tax Planning software of 2022 for your business.

Creating an asset inventory is a large part of. Planning ahead before the death of a spouse. Updated for Tax Year 2021 October 16 2021 1015 AM.

Beverly Bird has been a writer and editor for 30 years covering tax breaks tax preparation and tax law. That rate will be applied to any supplemental wages like bonuses up to 1 million during the tax year. If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year 2021 and the past two tax years 2020 2019.

A Complete Guide for Online Sellers. For the group the effect of acquisitions was largely offset by the effect of divestments. Group revenues were 4771 million up 4 overall and up 6 in constant currencies.

To help you prepare your tax return weve compiled the following list of qualified medical expenses. Congress has been working on a number of tax proposals for 2022While some tax proposals appear to have bipartisan support Congress has primarily focused on trying to rescue at least part of last years Build Back Better bill which. Pre-planning before a spouse dies will make things easier on the survivor.

For miles driven in 2021 the standard mileage deduction is 056 per mile.

The Best Tool For Tax Planning Physician On Fire

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Business Tax Deductions Small Business Tax Business Tax

Tax Prep Documents Checklist By H R Block Free Spreadsheet Template

The Best Tool For Tax Planning Physician On Fire

Small Business Checklist In 2022 Business Checklist Business Tax Checklist

Quickstudy Finance Laminated Reference Guide Small Business Tax Tax Prep Checklist Tax Prep

Free Printable Download Your Ultimate Simple Tax Preparation Checklist Tax Prep Checklist Personal Finance Checklist

Six Small Business Year End Tax Planning Moves To Make Now Hourly Inc

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Small Business Expenses Tax Checklist

Hairstylist Barber Manicurist Or Stylist Tax Preparation Checklist Hair Stylist Tax Preparation Diy Taxes

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Bookkeeping Business Small Business Planner Small Business Plan

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Estate Tax

Tax Prep Checklist In 2021 Tax Prep Checklist Tax Prep Managing Your Money

Tax Preparation Worksheet Pdf 2021 Fill Online Printable Fillable Blank Pdffiller

Six Small Business Year End Tax Planning Moves To Make Now Hourly Inc